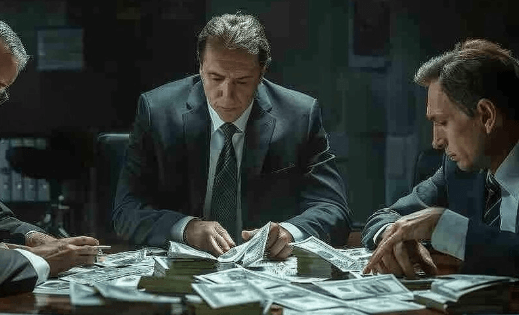

Kennedy Funding Ripoff Report

The Kennedy Funding Ripoff Report has emerged as a significant focal point for discussions around the company’s lending practices, revealing a troubling pattern of client dissatisfaction. Numerous borrowers have raised serious concerns regarding transparency, communication, and alleged financial misconduct. As these complaints grow in both number and intensity, they prompt important questions about the integrity of the lending process. What implications do these issues hold for both current and prospective clients, and how might Kennedy Funding respond to restore trust? The unfolding narrative warrants close examination.

Overview of Kennedy Funding

Kennedy Funding is a private lending institution that frequently specializes in providing capital for real estate developments and commercial projects, often catering to borrowers who may not qualify for traditional financing options.

The Kennedy Funding services encompass a streamlined funding process designed to facilitate access to necessary financial resources, thereby enabling clients to pursue their projects with greater flexibility and autonomy in the marketplace.

See also: Unblocked Games Wtf

Common Complaints and Allegations

Numerous complaints and allegations have emerged regarding the practices of Kennedy Funding, highlighting concerns about transparency, communication, and the overall customer experience in their lending process.

Reports of customer dissatisfaction often cite instances of financial misconduct, wherein clients feel misled or inadequately informed about terms and conditions.

Such issues raise significant questions about the integrity of their lending practices and the trustworthiness of their operations.

Evaluating the Claims and Experiences

Evaluating the claims and experiences of clients reveals a complex landscape of dissatisfaction and concern that merits careful examination of the specific practices and policies employed by Kennedy Funding.

Customer testimonials frequently highlight issues related to funding processes, suggesting a disconnect between expectations and reality.

A thorough analysis of these testimonials can provide insights into systemic flaws and areas requiring improvement for future client interactions.

Conclusion

In light of the mounting grievances associated with Kennedy Funding, a critical examination of the company’s practices reveals a troubling pattern of dissatisfaction.

As borrowers continue to share their experiences, the implications of these allegations extend beyond individual cases, hinting at systemic issues within the organization’s operations.

The future of Kennedy Funding hangs in the balance, with the potential for reputational damage looming large.

Will the company address these concerns, or will the cycle of mistrust persist?