Portfolio Impact & Returns Analysis for 120878323, 46819551, 1903919817, 649776232, 914842500, 1422746204

The Portfolio Impact & Returns Analysis for identifiers 120878323, 46819551, 1903919817, 649776232, 914842500, and 1422746204 reveals distinct performance dynamics. Each portfolio’s returns are scrutinized against established benchmarks. Additionally, risk exposures are assessed to identify potential vulnerabilities. This analysis serves as a foundation for strategic adjustments. The implications of these findings could significantly influence future investment decisions. Insights into specific performance metrics will further clarify the necessary steps for optimization.

Overview of Investment Portfolios

Investment portfolios serve as a structured collection of financial assets, designed to optimize returns while managing risk.

Effective portfolio diversification minimizes exposure to individual asset volatility, enhancing overall stability.

Sector allocation further refines this strategy, ensuring balanced investment across various industries.

Together, these principles empower investors to achieve their financial goals, fostering a sense of independence and control over their economic futures.

Performance Metrics and Analysis

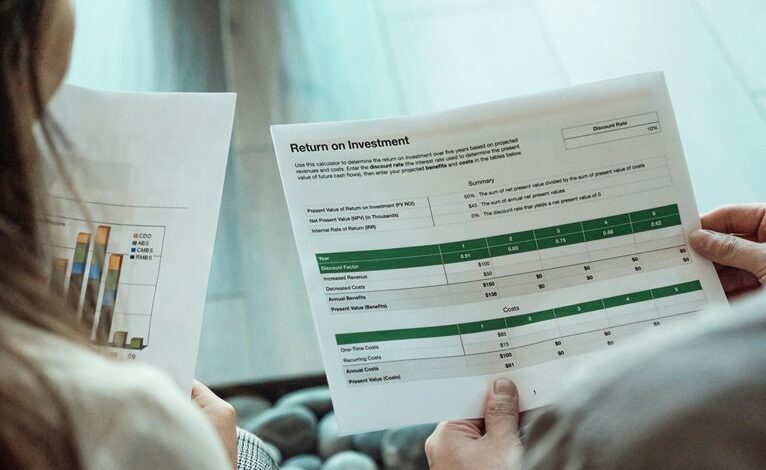

Evaluating the effectiveness of investment portfolios relies heavily on robust performance metrics and comprehensive analysis.

Utilizing performance benchmarks allows for a comparative assessment against market indices, while precise return calculations enable investors to gauge profitability.

Risk Assessment and Strategy Insights

Understanding performance metrics and comparative analyses provides a foundation for assessing risk within investment portfolios.

Evaluating risk tolerance, a robust diversification strategy, and appropriate asset allocation are crucial in navigating market volatility.

Investors must consider their investment horizon and liquidity needs to tailor their portfolios effectively.

This comprehensive approach enables informed decision-making, fostering resilience against potential downturns while optimizing returns.

Future Growth Potential and Recommendations

While assessing future growth potential, it is essential to analyze emerging market trends and technological advancements that could influence investment landscapes.

Growth forecasts indicate robust opportunities in sectors such as renewable energy and technology.

Strategic investments in these areas may yield substantial returns, offering investors the freedom to diversify portfolios while capitalizing on transformative shifts within the global economy.

Conclusion

In conclusion, the analysis of portfolios 120878323, 46819551, 1903919817, 649776232, 914842500, and 1422746204 reveals a landscape marked by diverse performance and risk profiles, akin to a garden requiring thoughtful pruning to flourish. By implementing strategic adjustments and enhancing risk management, these portfolios can cultivate greater returns and navigate the complexities of the market more effectively. The path forward is illuminated by targeted recommendations that align investments with overarching financial goals, ensuring sustainable growth.