From Chaos to Control: How Contra Entry Can Transform Your Finances

In the fast-paced world of finance, maintaining control over your organization’s financial transactions is crucial for success. Amidst the chaos of daily operations, leveraging tools like the contra entry can be transformative, offering a pathway to greater financial clarity and stability. In this insightful exploration, we’ll delve into the concept of contra entries, their role in financial management, and how they can empower businesses to navigate through uncertainty and achieve their goals.

Understanding Contra Entry: A Beacon of Order in Financial Chaos

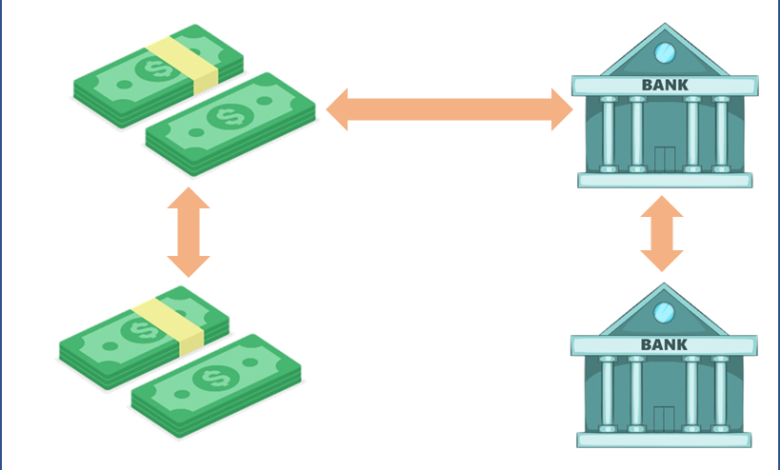

At its core, a contra entry is a unique financial transaction that serves to offset or reverse the impact of another entry. Unlike traditional journal entries that involve debiting one account and crediting another, contra entries involve debiting and crediting the same account, effectively neutralizing the original transaction. This mechanism is instrumental in rectifying errors, adjusting balances, and reflecting unusual transactions, thereby restoring order amidst financial chaos.

Harnessing the Power of Contra Entry: Key Transformative Aspects

1. Error Correction and Adjustment

One of the primary functions of contra entries is to rectify errors and discrepancies in financial records. Whether it’s reconciling accounts, adjusting balances, or addressing irregular transactions, contra entries provide a systematic framework for error correction, ensuring the accuracy and integrity of financial data.

2. Transparency and Accountability

By incorporating contra entries into financial reporting practices, businesses can enhance transparency and accountability in their operations. These entries serve as a clear audit trail, documenting adjustments and ensuring that financial statements accurately reflect the organization’s financial position and performance.

3. Strategic Decision-Making

Contra entries offer valuable insights that can inform strategic decision-making processes within an organization. By analyzing contra transactions, management can identify trends, assess the effectiveness of financial strategies, and make informed decisions to drive sustainable growth and profitability.

Navigating Financial Challenges: Practical Applications of Contra Entry

1. Reconciliation and Balancing

Contra entries play a crucial role in reconciling accounts and balancing financial statements. Whether it’s reconciling bank statements, inventory records, or accounts receivable/payable, contra entries provide a mechanism to address discrepancies and ensure the accuracy of financial reporting.

2. Adjusting Revenue and Expenses

Businesses can use contra entries to adjust revenue and expense accounts, reflecting returns, discounts, allowances, or other adjustments. By accurately capturing these transactions, organizations can track their true revenue and expenses, enabling more accurate financial analysis and forecasting.

3. Managing Assets and Liabilities

Contra entries are also instrumental in managing assets and liabilities effectively. Whether it’s depreciating fixed assets, adjusting allowances for doubtful accounts, or recognizing discounts on liabilities, contra entries enable businesses to reflect changes in asset and liability values accurately.

Implementing Best Practices: Maximizing the Benefits of Contra Entry

To harness the full potential of contra entries, businesses should adopt the following best practices:

1. Documentation and Record-Keeping

Maintain comprehensive documentation of contra transactions, including supporting documents and explanations for adjustments. This ensures transparency and facilitates auditing and compliance.

2. Regular Reconciliation and Review

Periodically reconcile contra accounts and review contra transactions to identify discrepancies or irregularities. Promptly address any issues to maintain the accuracy and integrity of financial records.

3. Training and Education

Invest in training and education for finance staff to ensure they understand the principles and practices of contra entry. Empower them to effectively utilize contra entries to optimize financial management processes.

Conclusion: Embracing Contra Entry for Financial Empowerment

In conclusion, the contra entry is a powerful tool that can transform financial chaos into control. By understanding its principles, harnessing its power, and implementing best practices, businesses can unlock new levels of financial clarity, transparency, and accountability. Embracing contra entry as a cornerstone of financial management empowers organizations to navigate challenges, make informed decisions, and achieve their strategic objectives in an ever-evolving economic landscape.